November 19, 2024 — In a historic first, Bitcoin (BTC) has surpassed the Canadian Dollar (CAD) in market capitalization, marking a significant moment in the evolution of digital currencies and their potential to challenge traditional fiat currencies.

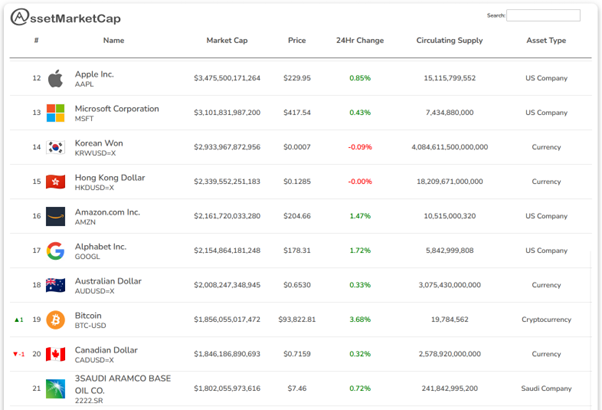

On November 19, 2024, Bitcoin’s market cap reached an impressive $1.856 trillion, while the Canadian Dollar’s market cap was recorded at $1.846 trillion, effectively making Bitcoin the larger currency by market cap for the first time in history. This marks the first instance of Bitcoin flipping the currency of a G7 country, further cementing its status as a global financial asset.

The Significance of the Flip

Bitcoin’s market capitalization overtaking the Canadian Dollar represents more than just a numerical milestone. It underscores a broader trend of increasing institutional and retail adoption of cryptocurrencies, as well as a shift in how investors view digital assets in comparison to traditional fiat currencies. For years, Bitcoin has been viewed as both a speculative investment and a hedge against traditional financial systems, and this flip provides a clear indication that it is continuing to grow in both importance and acceptance.

The event also signals a new level of confidence in Bitcoin as a store of value, especially at a time when traditional fiat currencies face increasing scrutiny and volatility. Central banks around the world have been grappling with inflationary pressures, rising interest rates, and growing debt burdens, which have prompted many investors to look for alternative stores of value — with Bitcoin often leading the charge.

In terms of market dynamics, Bitcoin’s $1.856 trillion market cap is a reflection of its broader market influence. The digital currency has become a fixture in portfolios ranging from individual investors to multinational institutions, and its market performance can no longer be dismissed as a fleeting trend.

A Global Shift in Currency Perception

While Bitcoin’s rise in market cap is a remarkable feat, its flipping of the Canadian Dollar is particularly notable given Canada’s position in the global economy. As a member of the G7 — a group of the world’s seven largest advanced economies — Canada is a major player in the global financial system, and the Canadian Dollar has long been seen as one of the more stable and widely used currencies worldwide.

However, the rise of cryptocurrencies over the past decade has led to a paradigm shift in the way we view money. Central banks are under increasing pressure to modernize their monetary systems, especially in light of the growing appeal of decentralized digital assets like Bitcoin. The Canadian government, like many others, has expressed both interest and concern about the rise of cryptocurrencies, balancing innovation with regulatory efforts aimed at protecting consumers and the financial system.

Bitcoin’s market cap surpassing the Canadian Dollar may indicate that people are beginning to view decentralized assets as more than just a speculative bubble. For some, it signals the future of money, one that is borderless, censorship-resistant, and less susceptible to the traditional issues of inflation and currency devaluation.

Institutional Adoption and Bitcoin’s Rise

One of the key factors driving Bitcoin’s surge in market cap has been its increasing institutional adoption. Over the past few years, major companies and financial institutions — including Tesla, MicroStrategy, and several large hedge funds — have significantly increased their Bitcoin holdings. Furthermore, Bitcoin ETFs (Exchange-Traded Funds) have also played a role in making it easier for retail and institutional investors to gain exposure to the cryptocurrency.

At the same time, global financial institutions and regulators have been grappling with how to classify and regulate Bitcoin. In the U.S., the SEC has sought to establish clearer rules for cryptocurrency markets, while European regulators have introduced their own frameworks. In Canada, the regulatory approach to Bitcoin and other digital assets has been relatively progressive, allowing for greater market participation without stifling innovation.

As institutional players continue to adopt Bitcoin as part of their portfolios and companies integrate it into their balance sheets, the currency’s market capitalization is likely to continue growing. This trend could pave the way for Bitcoin to challenge other fiat currencies in the future, potentially even challenging the U.S. Dollar as the dominant global reserve currency in the longer term.

What Does This Mean for the Canadian Dollar?

While Bitcoin flipping the Canadian Dollar might be viewed as a symbolic event, it’s unlikely to cause immediate changes to Canada’s monetary system. The Canadian Dollar remains a strong and stable fiat currency that is widely accepted in both Canada and globally. However, Bitcoin’s growing market cap could exert pressure on governments and central banks to consider new monetary policies and frameworks that incorporate digital currencies into the global financial system.

For Canadians, the flip may prompt greater interest in Bitcoin as an alternative investment or as a hedge against inflation. Given the increasing accessibility of cryptocurrencies through exchanges and financial products, Canadians might find themselves more inclined to diversify their portfolios into digital assets, particularly Bitcoin.

The Bigger Picture

This milestone is part of a larger narrative surrounding the evolution of money. Over the past decade, Bitcoin has proven its resilience, overcoming skepticism, regulatory challenges, and volatility to become one of the most significant assets in the global economy. Its ascent as the larger asset compared to a major G7 currency like the Canadian Dollar reflects the shifting tides in the global financial system, where decentralized technologies are playing an increasingly important role.

While Bitcoin’s flip of the Canadian Dollar is a remarkable event, it is likely to be just the beginning. As adoption grows and digital assets become more integrated into the global financial ecosystem, we may see more currencies flip in the coming years. With Bitcoin now challenging traditional fiat currencies on a more significant scale, the landscape of global finance is clearly undergoing a transformation.

For now, Bitcoin’s rise above the Canadian Dollar serves as a reminder that the world of finance is changing, and the future of money may look very different from what we know today. As this shift continues, it will be fascinating to see how traditional currencies and institutions respond to the growing influence of decentralized digital assets like Bitcoin.

Conclusion

Bitcoin flipping the Canadian Dollar in market cap is a major milestone that highlights the ongoing rise of digital currencies and their growing prominence in the global financial system. As Bitcoin continues to gain traction, its market cap could continue to outpace that of traditional currencies, signaling a potential shift toward a more decentralized and digital future for global finance.

Leave a Reply