11/11/2025

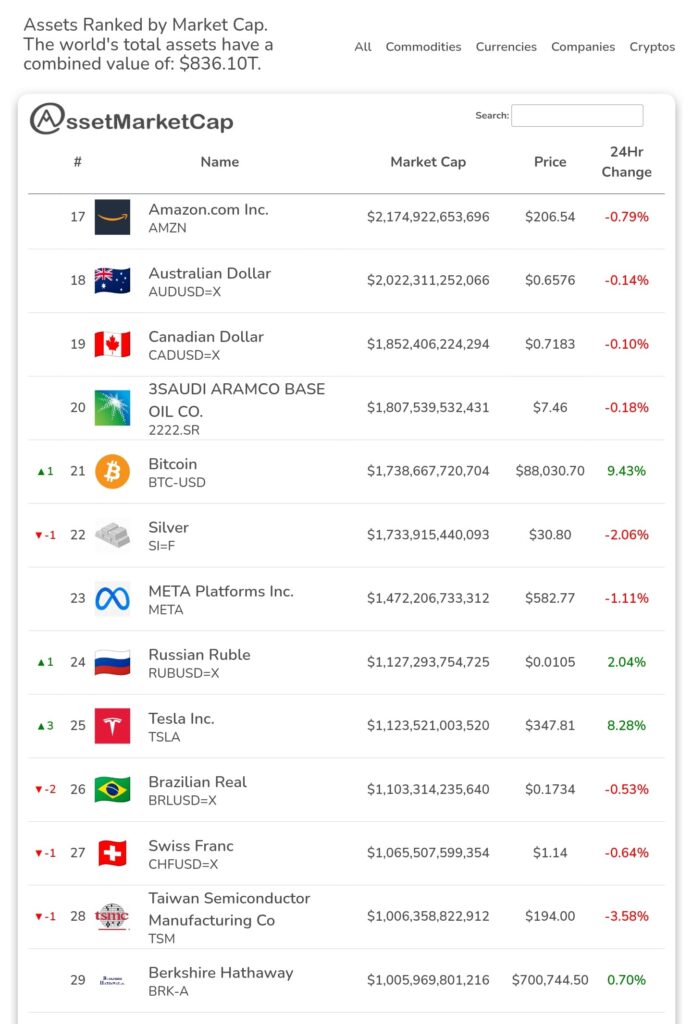

In a groundbreaking moment for global finance, Bitcoin (BTC) has officially surpassed silver in both market capitalization and price as of November 11, 2025. The cryptocurrency, often referred to as “digital gold,” now boasts a market cap of $1.738 trillion, narrowly edging out silver’s long-standing $1.733 trillion valuation.

Bitcoin’s price surged to $88,030 per coin, equating to $30.80 per troy ounce—higher than silver’s $30.80 per ounce. The achievement solidifies Bitcoin’s position as a dominant force in the financial world, rivaling traditional commodities and reshaping perceptions of value.

A Clash of Asset Titans

The competition between Bitcoin and silver has been closely watched, with each asset representing a distinct class. Silver has traditionally served dual roles as both a safe-haven precious metal and a critical industrial resource. Its applications in electronics, renewable energy, and medicine have sustained its demand over centuries.

Bitcoin, on the other hand, is a purely digital asset that has gained traction as an inflation hedge, store of value, and speculative investment. Its limited supply of 21 million coins, combined with growing adoption, has fueled its meteoric rise over the past decade.

Breaking Down the Numbers

Silver’s $1.733 trillion market cap is supported by an estimated total above-ground stock of 56.3 billion ounces. Meanwhile, Bitcoin’s market cap of $1.738 trillion is derived from its circulating supply of approximately 19.75 million BTC at the current price of $88,030 per coin.

For comparison:

- Silver price: $30.80/oz

- Bitcoin price: $88,030/BTC

Bitcoin’s ascent over silver highlights a major shift in investor sentiment, as traditional commodities struggle to keep pace with the explosive growth of digital assets.

Key Drivers of Bitcoin’s Surge

Several factors have contributed to Bitcoin’s latest rally, including:

- Institutional Adoption: Major corporations, hedge funds, and even sovereign wealth funds have increased their Bitcoin holdings.

- Regulatory Clarity: Clearer global regulations have made Bitcoin more accessible to both institutional and retail investors.

- Inflation Concerns: With inflationary pressures persisting in many economies, Bitcoin is increasingly viewed as a hedge, akin to gold and silver.

- Technological Advancements: The rollout of the Bitcoin Lightning Network and other scalability solutions has bolstered Bitcoin’s utility as both a store of value and a medium of exchange.

Silver: Resilient but Outpaced

While silver has lagged behind Bitcoin in terms of price growth, it remains an essential commodity in industrial applications, particularly in the renewable energy sector. Demand for silver in solar panel production and electric vehicles has been robust, but it has not matched the speculative fervor driving Bitcoin’s value.

“Silver is still a critical material for the green energy revolution, but its price is constrained by its industrial nature,” said Elena Vasquez, a commodities analyst at EcoMarkets. “Bitcoin, in contrast, benefits from speculative enthusiasm and the narrative of scarcity.”

Market Reactions

Bitcoin enthusiasts have celebrated the milestone, hailing it as validation of the cryptocurrency’s potential to challenge and even replace traditional asset classes.

“Bitcoin overtaking silver is not just a victory for cryptocurrency; it’s a clear signal that the world is shifting toward digital assets,” said Michael Chan, CEO of CryptoFund Global.

Meanwhile, silver advocates caution against dismissing the metal’s intrinsic value. “Silver has stood the test of time for centuries,” argued commodities trader Laura Richards. “Bitcoin’s volatility means its dominance could be short-lived.”

Looking Ahead

The overtaking of silver by Bitcoin in both market cap and price marks a historic moment in the evolution of global financial markets. As Bitcoin’s prominence continues to grow, questions linger about its ability to maintain momentum and its implications for traditional assets.

Whether this milestone signals a permanent transformation or a fleeting trend, one thing is certain: Bitcoin’s ascent is reshaping the narrative of value in the modern era.

Leave a Reply