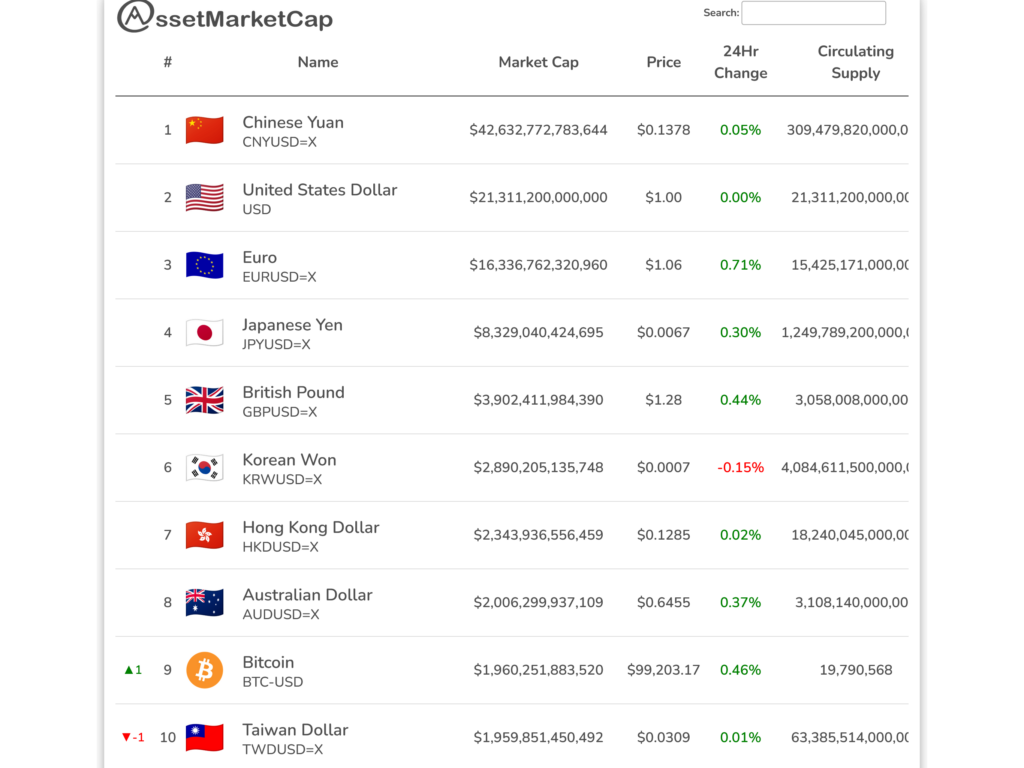

In a historic moment for the cryptocurrency market, Bitcoin (BTC) has shattered the $100,000 milestone, reaching a total market capitalization that now exceeds the Australian Dollar’s M2 money supply for the first time. This achievement solidifies Bitcoin’s status as a significant global financial asset, marking its growing adoption and recognition as a decentralized store of value.

As of today, Bitcoin’s market cap has surged past $2 trillion, surpassing the Australian Dollar’s M2 supply, which is approximately $1.97 trillion. This development has profound implications for the global financial system, highlighting Bitcoin’s growing influence in an increasingly digital and decentralized economy.

Bitcoin’s $100K Breakthrough: The Factors Behind the Surge

Bitcoin’s rise past $100,000 has been driven by a combination of macroeconomic, technological, and institutional factors, signaling a turning point in the broader adoption of cryptocurrencies.

- Institutional Adoption at Record Levels

Over the past year, Bitcoin has seen unprecedented interest from institutional investors, including hedge funds, corporations, and even sovereign wealth funds. Major firms have continued to add Bitcoin to their balance sheets as a hedge against inflation and currency devaluation. Additionally, recent developments in Bitcoin-based exchange-traded funds (ETFs) have provided institutional investors with regulated avenues to gain exposure to Bitcoin, further driving demand and pushing its price higher. - Macroeconomic Tailwinds

With inflation remaining persistent across major economies and central banks hesitant to raise interest rates aggressively, Bitcoin’s appeal as a hedge against fiat currency depreciation has only grown. Its fixed supply of 21 million coins has proven to be an attractive alternative to inflation-prone national currencies like the Australian Dollar. - Retail and Global Adoption

Beyond institutional interest, retail adoption of Bitcoin continues to accelerate. With Lightning Network scaling solutions improving transaction speed and reducing costs, Bitcoin is increasingly being used for payments, remittances, and everyday transactions in emerging markets. Countries like El Salvador and others adopting Bitcoin as legal tender have further contributed to its legitimacy as a global financial asset. - Digital Gold Narrative

Bitcoin’s narrative as “digital gold” has resonated strongly with investors seeking a modern, decentralized, and secure store of value. Its ability to transcend borders, operate independently of centralized authorities, and resist censorship has made it a preferred choice for individuals and institutions alike.

Why Passing the Australian Dollar M2 Matters

The M2 money supply measures a nation’s total amount of money in circulation, including cash, savings accounts, and other liquid assets. Surpassing the Australian Dollar’s M2 supply is a landmark event because it represents Bitcoin outpacing the value of an established national currency backed by one of the world’s strongest economies.

Australia’s M2 market cap, estimated at $1.97 trillion, reflects the sum of all circulating Australian Dollars. Bitcoin, now exceeding this figure, underscores its evolution from a niche digital currency to a global monetary system rivaling traditional fiat currencies.

This development not only highlights Bitcoin’s role as a store of value but also signals its growing acceptance as a legitimate alternative to government-backed currencies.

The Global Implications

Bitcoin surpassing the Australian Dollar’s M2 supply carries significant implications for global finance:

- Challenges to Traditional Currencies: Bitcoin’s rise highlights growing skepticism toward fiat currencies, particularly in the context of inflation and monetary policy decisions. As Bitcoin gains prominence, it may increasingly challenge smaller national currencies in terms of utility and perceived value.

- Legitimacy for Cryptocurrencies: Bitcoin’s $100,000 milestone and its growing market cap provide further validation for cryptocurrencies as an asset class. This success is likely to boost interest in other digital assets, spurring innovation across the blockchain ecosystem.

- Central Bank Digital Currencies (CBDCs): Bitcoin’s success underscores the urgency for central banks to accelerate the development of their own digital currencies. As private cryptocurrencies like Bitcoin gain traction, central banks may face mounting pressure to adapt to the changing financial landscape.

What’s Next for Bitcoin?

Bitcoin breaking $100,000 and surpassing the Australian Dollar M2 supply is a milestone that will likely be remembered as a defining moment in the cryptocurrency’s journey. The achievement underscores Bitcoin’s resilience and its growing adoption as a decentralized alternative to traditional financial systems.

However, Bitcoin’s future will depend on its ability to maintain its momentum and navigate challenges such as regulatory scrutiny, network scalability, and competition from both traditional assets and newer cryptocurrencies.

For now, Bitcoin’s rise to $100,000 is a testament to the strength of its underlying fundamentals, its increasing global adoption, and its growing role as a transformative financial asset.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risks, and readers are encouraged to conduct thorough research before investing.

Leave a Reply