**Summary:** MetaMask, the popular self-custodial crypto wallet from ConsenSys, is set to revolutionize access to tokenized US stocks, ETFs, and commodities by leveraging Ondo Global Markets. Starting this week, eligible users outside the US can trade these assets via the Ethereum network, marking a significant step towards integrating traditional finance with the burgeoning world of decentralized finance (DeFi). However, the rollout will exclude users in 30 jurisdictions, including Canada and the UK.

—

### MetaMask’s Bold Step into Tokenized Assets: A New Era for Global Investors

In a groundbreaking move that bridges the gap between traditional finance and the blockchain ecosystem, MetaMask has launched features that enable users to trade tokenized US stocks, exchange-traded funds (ETFs), and commodities. This initiative, powered by Ondo Global Markets, represents a pivotal moment in the evolution of decentralized finance (DeFi), particularly for non-US investors. As the financial landscape continues to shift toward digitization, this development raises numerous questions about accessibility, regulatory compliance, and the future of investment strategies.

#### The Launch Details: What’s New?

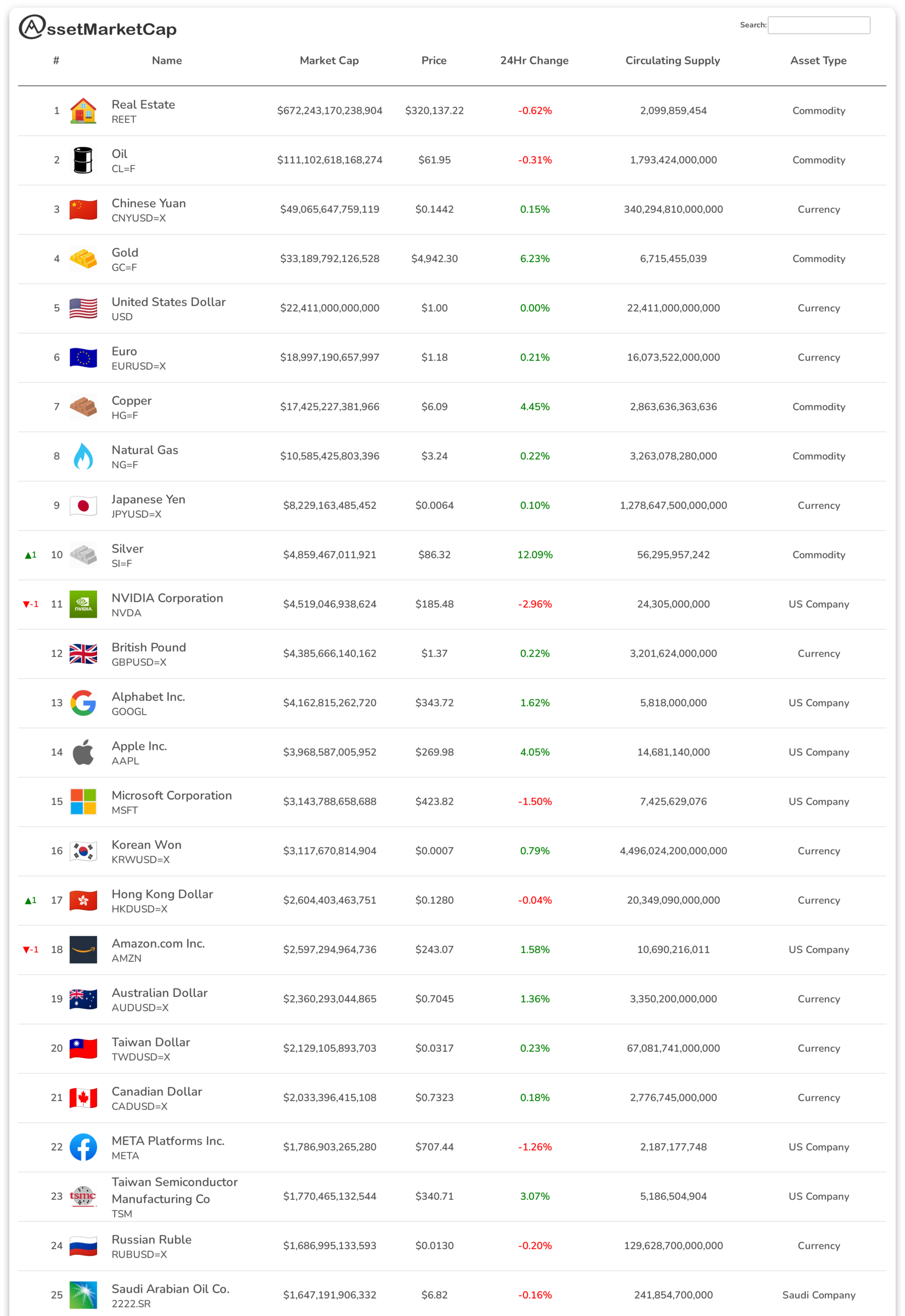

On a Tuesday announcement that caught the attention of fintech enthusiasts, MetaMask revealed that eligible users outside the United States can now access 200 tokenized US stocks, ETFs, and commodities, including precious metals like gold and silver. These tokenized assets will be available on the Ethereum network, allowing users to acquire them through MetaMask Swaps. This process involves swapping Circle’s USDC stablecoin for Ondo Global Markets (GM) tokens, which are designed to mirror the value of the underlying assets on a 1:1 basis.

The rollout is part of MetaMask’s broader mission to create a self-custodial wallet that simplifies the trading of both crypto and traditional assets. Joe Lubin, co-founder of Ethereum and CEO of ConsenSys, emphasized the importance of this integration by stating, “Access to US markets still runs through legacy rails,” pointing out the inefficiencies of traditional trading systems. He envisions a future where MetaMask serves as a comprehensive solution for users, enabling seamless transitions between different asset classes without intermediaries.

#### Implications of the Launch

The introduction of tokenized assets through MetaMask is not just a technological upgrade but a significant shift in how investors can access and manage their portfolios. Here are several implications stemming from this launch:

1. **Increased Accessibility for Non-US Investors**: The primary beneficiaries of this rollout are users located outside the United States. With the exclusion of US residents and a number of other jurisdictions—namely, Canada, the European Economic Area, and the UK—MetaMask is catering to a growing demand for global investment opportunities in a decentralized context.

2. **Potential for Regulatory Challenges**: While the launch opens doors for many, it also raises questions about compliance with varying international regulations. A representative from ConsenSys noted that MetaMask uses multiple methods, including IP address tracking, to enforce geographical restrictions. The ongoing evolution of regulatory frameworks will be crucial as MetaMask seeks to expand access in a compliant manner.

3. **Shift Toward Real-World Assets (RWAs)**: This move aligns with a broader trend in the crypto industry where major players are integrating RWAs into their platforms. Companies like Coinbase and Trust Wallet are also exploring tokenized assets, highlighting a collective push towards what is being termed the “everything app” model in finance.

#### Historical Context: The Rise of Tokenization

To fully appreciate the significance of MetaMask’s latest offerings, it is essential to understand the context of asset tokenization. The concept involves representing real-world assets—such as stocks, commodities, and real estate—on a blockchain, allowing for fractional ownership and more accessible trading options. This innovation has gained traction over recent years as investors seek to leverage the benefits of blockchain technology, including transparency, security, and liquidity.

The tokenization movement has been fueled by the rise of DeFi platforms, which aim to disrupt traditional finance by providing decentralized alternatives to banking and investment services. With the advent of smart contracts and decentralized exchanges, tokenized assets can be traded directly between users without the need for intermediaries, thereby reducing costs and increasing efficiency.

#### The Competitive Landscape: MetaMask vs. Other Wallets

MetaMask’s foray into tokenized assets places it in direct competition with other crypto wallets and exchanges that have begun to explore similar offerings. For example:

– **Coinbase**: The largest US crypto exchange by trading volume announced its plans to develop a platform for tokenized RWAs, named Coinbase Tokenize. This initiative is intended to provide users with a comprehensive trading experience that includes both crypto and traditional assets.

– **Trust Wallet**: Backed by Binance co-founder Changpeng Zhao, Trust Wallet integrated tokenized assets in September 2025 and has also ventured into prediction markets, demonstrating the growing interconnection between different financial products.

– **Polymarket**: In October 2025, MetaMask partnered with Polymarket to offer prediction markets directly on its mobile platform, further diversifying the range of services available to users.

This competitive landscape indicates a significant shift in how financial services are being delivered, with self-custodial wallets emerging as key players in the evolving market.

#### User Experience and Future Developments

Initially, the tokenized asset offerings will be available exclusively on the MetaMask mobile application, with desktop support expected by late February. The decision to prioritize mobile access aligns with the increasing trend of users engaging with financial applications on their smartphones. This focus on user experience is crucial, as seamless navigation and intuitive design are essential for attracting and retaining users in a crowded market.

As users begin to interact with tokenized assets, the implications of this technology will likely become more apparent. The potential for increased liquidity, enhanced trading capabilities, and broader market access could redefine investment strategies, especially for those looking to diversify their portfolios with both traditional and digital assets.

#### The Road Ahead: Challenges and Considerations

While the launch of tokenized assets through MetaMask is a promising development, it is essential to recognize the challenges that lie ahead. Regulatory scrutiny is likely to intensify, especially as governments and financial authorities grapple with the implications of tokenized assets on traditional financial systems. Ensuring compliance while expanding access will be a delicate balancing act for MetaMask and other platforms venturing into this space.

Moreover, user education will play a critical role in the successful adoption of these new features. As individuals navigate the complexities of trading tokenized assets, understanding the associated risks and benefits will be paramount. Initiatives aimed at educating users about the mechanics of tokenization, as well as the broader implications for their investment strategies, will be essential for fostering trust and encouraging engagement.

#### Conclusion: A Transformative Step for Finance

MetaMask’s introduction of tokenized US stocks, ETFs, and commodities through Ondo Global Markets signifies a transformative step in the ongoing convergence of traditional finance and decentralized systems. As the boundaries between these worlds continue to blur, investors are presented with unprecedented opportunities to access and manage their assets.

This initiative not only highlights the growing demand for tokenized assets but also underscores the need for innovative solutions that cater to a diverse global audience. As MetaMask and its competitors navigate the complexities of regulatory compliance and user education, the future of finance looks increasingly decentralized, accessible, and interconnected.

The rollout of tokenized assets is just the beginning. As the crypto landscape evolves, the potential for new financial products, services, and investment strategies will undoubtedly expand, paving the way for a more inclusive and dynamic financial ecosystem. As we look toward the future, it will be fascinating to observe how these developments shape the investment landscape and redefine the way we think about ownership and assets.

Original source: https://cointelegraph.com/news/metamask-tokenized-stocks-etfs-commodities-ondo?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

Leave a Reply