### The Rise of Olympic Medals as Financial Assets

As we turn our gaze towards the upcoming 2026 Winter Olympics in Milan-Cortina, Italy, a significant shift is occurring in the financial landscape surrounding Olympic medals. Notably, the soaring prices of precious metals have propelled these awards to unprecedented valuations. This shift isn’t merely about the accolades of victory; it also reflects a broader trend in financial markets that athletes are beginning to capitalize on.

### A Historic Surge in Gold Prices

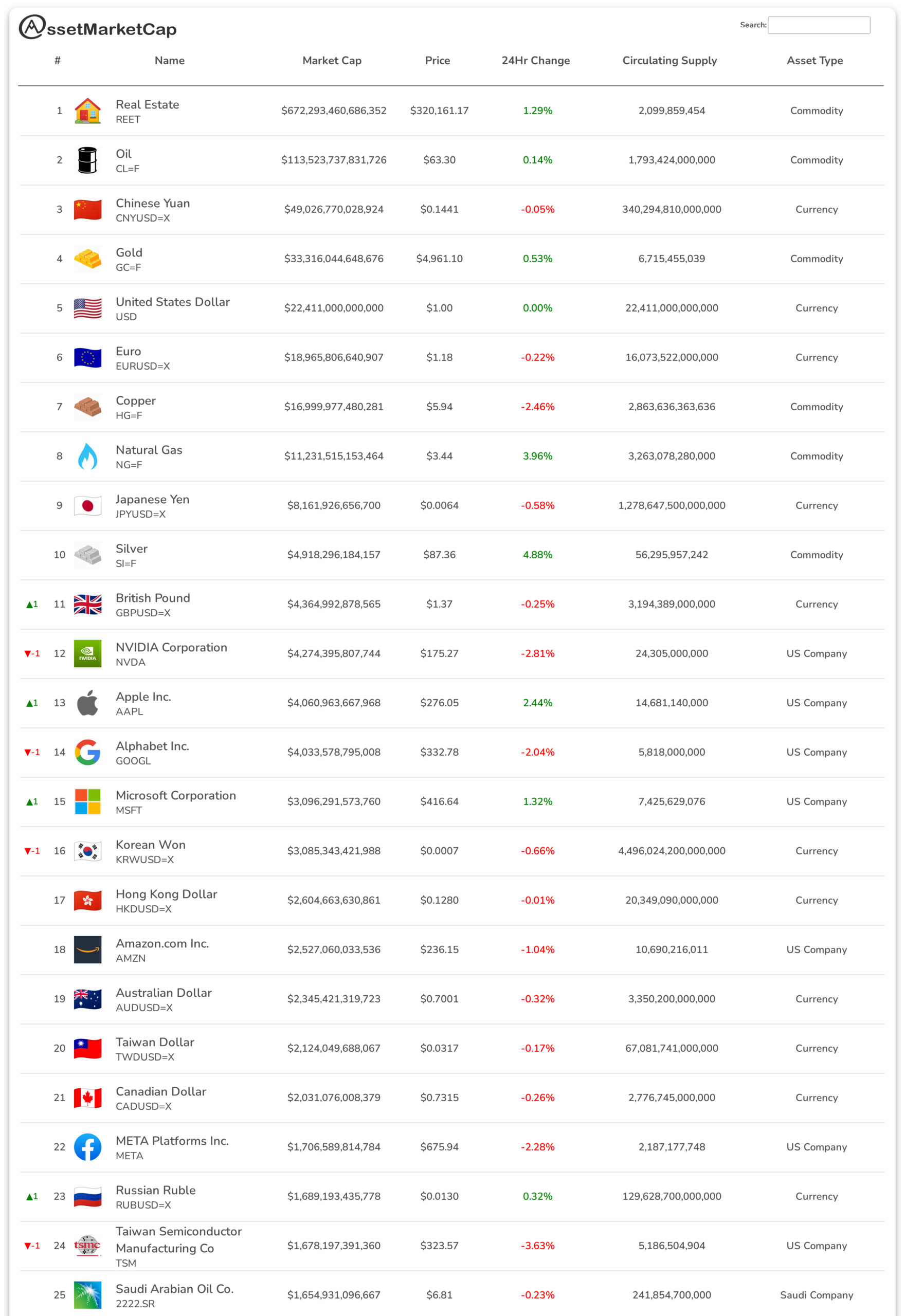

The past few years have seen a remarkable increase in the price of gold, nearly doubling from approximately $2,800 to over $5,000 per ounce since early 2025. This surge of nearly 80% has been driven by various factors, including economic uncertainties and rising inflation, prompting investors to seek safer investment havens. Historically, gold has been viewed as a stable asset, especially during turbulent economic times, and this trend underscores that perception.

Similarly, silver has experienced an even more dramatic increase, with prices soaring from about $32 to nearly $90 per ounce—an eye-watering increase of around 182%. This stark contrast is particularly relevant as the raw material content of Olympic medals becomes a topic of interest for both athletes and collectors alike.

### The Value of Olympic Medals

Olympic medals are not merely symbols of athletic achievement; they now represent substantial financial assets. The gold medals awarded at the upcoming Olympics will be composed of approximately 6 grams of gold, plated over a base of silver. The total metal value of each gold medal is estimated to be around $2,400, a significant leap from the roughly $900 value during the 2024 Games in Paris.

In comparison, Olympic silver medals, made from 500 grams of pure silver, will hold an approximate intrinsic value of $1,400. Bronze medals, while still a mark of achievement, are made from a more abundant material and carry far less financial weight.

### Medals as Tangible Symbols of Intangible Achievements

While the raw metal value of Olympic medals has risen, their true worth extends far beyond the material. The medals symbolize years of dedication, training, and sacrifice, making them highly coveted by collectors and fans. As Michele Sciscioli, the CEO of the Italian state mint, remarked, “The medals are tangible rewards for intangible efforts.” This perspective emphasizes the historical and emotional significance of the medals, which can fetch remarkable prices at auction.

For instance, Ryan Lochte, a former U.S. Olympic swimmer, recently sold three of his gold medals for a staggering total of $385,520—averaging over $125,000 each. Lochte noted on Instagram, “I never swam for the gold medals… Those medals? They were just the cherry on top of an incredible journey.” This sentiment resonates with many athletes, reflecting the complex relationship between personal achievement and financial validation.

### Financial Support for Athletes: A New Era

The financial landscape for Olympic athletes is changing, not just through the increased value of their medals but also in the form of direct financial support. While winning an Olympic medal is a life-changing achievement, the financial rewards from the U.S. Olympic & Paralympic Committee are not substantial enough to sustain an athlete’s career long-term. Gold medalists receive $37,500, silver medalists $22,500, and bronze medalists $15,000—amounts that, while meaningful, may not cover the extensive costs associated with training and competition.

Recognizing this gap, billionaire Ross Stevens, founder and CEO of Stone Ridge Asset Management, has taken a groundbreaking step by providing every U.S. Olympic and Paralympic athlete with $200,000, regardless of whether they win a medal. This initiative is designed to alleviate financial stress, allowing athletes to focus on their performance without the burden of financial insecurity. Half of this amount will be deferred until the athlete reaches 45 years of age or 20 years after their first Olympic appearance, ensuring long-term financial support. Upon the athlete’s death, the remaining funds will be guaranteed to their families.

In Stevens’ own words, “I do not believe that financial insecurity should stop our nation’s elite athletes from breaking through to new frontiers of excellence.” This commitment highlights a growing recognition of the financial challenges faced by athletes, even those who achieve the highest levels of success in their respective sports.

### The Broader Implications for Sports and Finance

The intersection of sports and finance is becoming increasingly apparent, with Olympic medals emerging as both symbols of achievement and valuable commodities. This trend raises critical questions about the future of athlete compensation, sponsorships, and the financial implications of Olympic participation.

#### The Evolving Landscape of Athlete Sponsorships

As the value of Olympic medals rises, so too does the potential for athletes to leverage their achievements into lucrative sponsorships. Companies are increasingly looking to partner with Olympic athletes to enhance their brand visibility and connect with a passionate audience. However, many athletes still face uncertainty in securing long-term sponsorship deals, especially post-retirement.

The recent shift towards financial support for athletes, as seen with Stevens’ initiative, could pave the way for new models of athlete compensation. This evolution could inspire other organizations and sponsors to rethink how they support athletes, providing financial stability both during and after their competitive years.

#### The Impact on Future Olympians

For aspiring athletes, the increasing financial value of Olympic medals offers new motivation to pursue their dreams. However, it also highlights the importance of planning for the future. Young athletes must navigate the delicate balance between intense training schedules and financial literacy, ensuring they are prepared for the challenges that lie ahead, both during and after their athletic careers.

Moreover, the rising value of medals serves as a reminder that achievements in sports can translate into financial opportunities, encouraging athletes to view their accomplishments through a dual lens of passion and pragmatism.

### Conclusion: A Golden Future for Athletes

As the world prepares for the 2026 Winter Olympics, the rising value of medals and the evolving financial support systems for athletes signify a new era in the sports landscape. The convergence of athletics and finance brings both challenges and opportunities, reshaping how we view not just Olympic medals, but the athletes who earn them.

In this context, athletes are not only competitors; they are also emerging as financial assets in a complex and often precarious world. As the lines blur between sport and finance, the future holds promise for a generation of Olympians, allowing them to achieve both their athletic aspirations and financial security. The focus is shifting from merely winning medals to understanding and harnessing their intrinsic value—an evolution that could redefine the Olympic experience for years to come.

Leave a Reply