## The AI Revolution: A Double-Edged Sword

Artificial Intelligence (AI) has long been heralded as a transformative force in the corporate world, particularly in technology. For years, it has been perceived as a boon for tech stocks, driven by a staggering $600 billion in annual corporate capital expenditures (capex) that fuel AI innovations. These investments were expected to lead to increased efficiencies and profits for both tech and non-tech companies alike. However, recent developments have revealed a darker side to this narrative, sending shockwaves through the stock market.

## A Sudden Shift in Sentiment

In a dramatic turn of events, traders have begun to realize that while AI is capable of generating new revenue streams, it also poses a significant threat to existing tech companies. This realization was crystallized during a recent earnings call featuring Palantir CEO Alex Karp and CTO Shyam Sankar, where they outlined how AI technologies could potentially overshadow many established tech firms. Their assertions highlighted a crucial point: AI is now advanced enough to perform tasks traditionally handled by enterprise software, jeopardizing the revenue streams of various Software-as-a-Service (SaaS) companies that have thrived in this space.

The implications were immediate and severe, leading to a widespread sell-off across tech stocks. In just one trading session, investors wiped away a staggering $300 billion in market capitalization.

## The Market Reaction: A Snapshot of the Decline

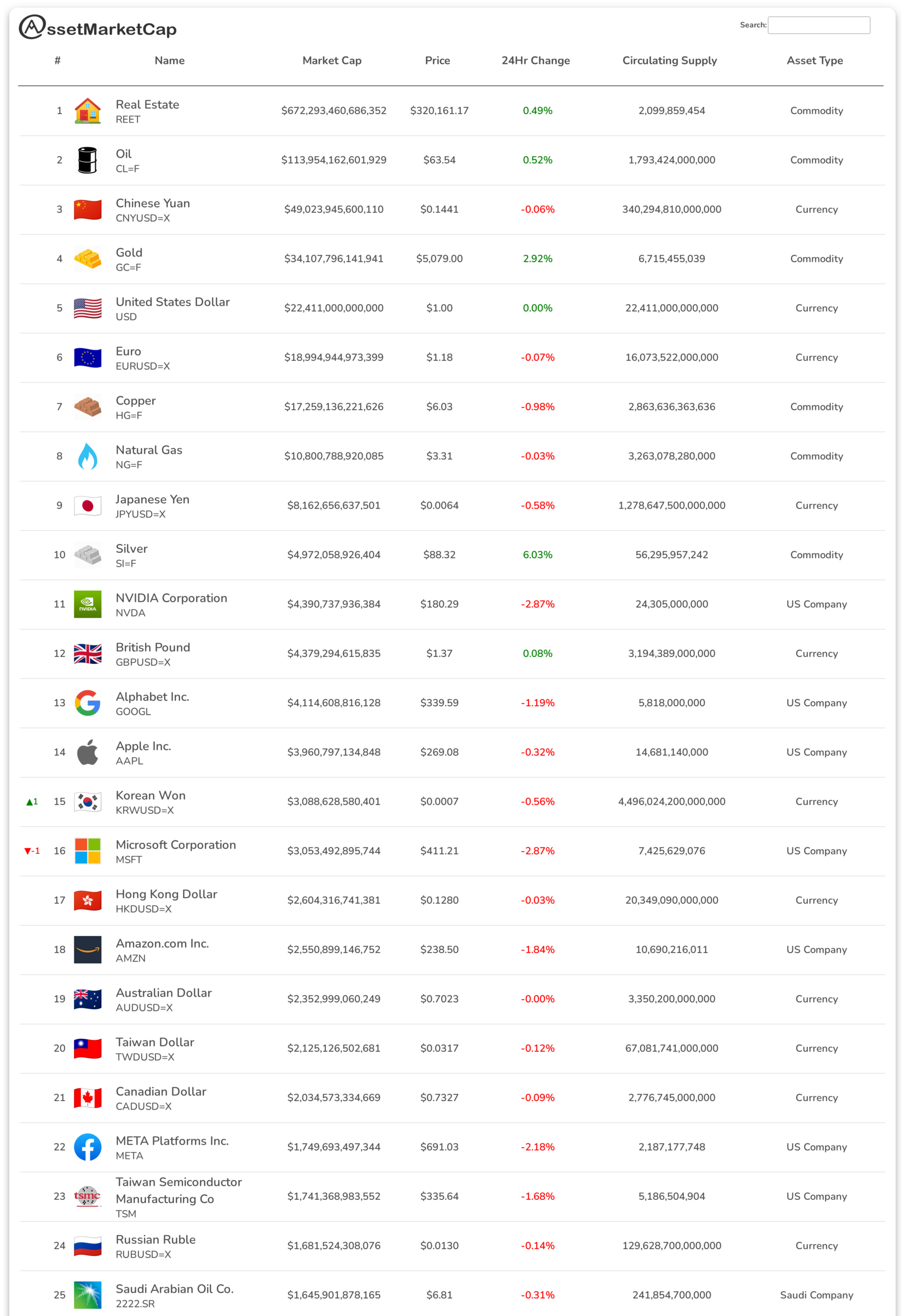

As the market opened the following day, reactions were palpable. The S&P 500 futures remained flat, reflecting caution among traders after the previous day’s losses. Notably, key players in the SaaS sector faced significant downturns:

– **Microsoft** closed down 2.87%

– **SAP** was down 3.29%

– **Salesforce** plummeted by 6.85%

– **ServiceNow** experienced a 6.97% decline

– Other tech stocks were also affected, with many lingering in the red overnight.

This caution among investors signals a broader reevaluation of tech stocks, prompting many to question the sustainability of current valuations.

## AI’s Disruptive Potential: Insights from Industry Leaders

During the earnings call, Palantir’s Sankar introduced the “AI Forward Deployed Engineer” product, which promises to revolutionize enterprise software management. This innovative tool enables clients to manage software and code bases through natural language commands, dramatically reducing complex ERP (Enterprise Resource Planning) migration timelines from years to mere weeks. Such efficiencies challenge the traditional revenue models of many tech firms, particularly those reliant on long-term software contracts.

Karp further emphasized the growing demand for AI solutions, noting that numerous companies have already witnessed successful implementations of AI tools. This shift creates an environment where businesses are increasingly looking for ways to cut costs and streamline operations, further endangering the profitability of legacy software providers.

## Market Analysts Weigh In

Analysts have begun to voice concerns about the ramifications of this emerging AI landscape. Notably, Akshat Agarwal and Ayush Bansal of Jefferies issued a report indicating that AI could severely impact the revenues of a wide range of tech companies. They pointed out that many IT firms derive 40-70% of their revenues from application services, which are now under threat as AI technologies advance.

Their report warns of a potential growth slowdown for these firms, as consensus growth estimates may not accurately reflect the impending challenges. Analysts cautioned that AI could erode application service revenues significantly, leading to a downward adjustment in valuations for tech stocks.

## The Broader Implications for Tech Firms

The ramifications of AI’s disruptive capabilities extend beyond immediate revenue concerns. Here are some broader implications for the tech industry:

– **Erosion of Business Models**: Traditional SaaS companies may need to rethink their business models as AI-driven solutions become increasingly prevalent. This could lead to a reevaluation of pricing strategies and service offerings.

– **Innovation Pressure**: Companies must innovate rapidly to stay competitive in an environment where AI tools can outperform human-driven solutions. Failure to adapt may result in obsolescence.

– **Investment Shifts**: Investors may shift their focus from established tech giants to companies specializing in AI or those capable of leveraging AI technologies effectively. This transition could redefine market leadership.

– **Job Displacement**: As AI systems become more capable, there is a growing concern about job displacement in the tech sector. Companies may need to balance automation with human employment considerations.

## Comparing AI’s Impact Across Industries

The implications of AI’s rise are not isolated to the tech sector. Various industries are experiencing similar pressures as AI technologies become increasingly integrated into their operations. For example:

– **Healthcare**: AI is transforming diagnostics, treatment planning, and patient management, potentially reducing the need for traditional roles in medical administration.

– **Finance**: Automated trading systems driven by AI are revolutionizing investment strategies, leading to more efficient markets but also raising concerns about job losses in trading and analysis roles.

– **Manufacturing**: AI-driven automation is enhancing production efficiency, but it also raises questions about job security for assembly line workers.

## The Road Ahead: Navigating the AI Landscape

As we look to the future, the tech industry must navigate a complex landscape shaped by AI. Here are some strategies for companies and investors to consider:

– **Emphasize Adaptability**: Companies must prioritize flexibility in their operations, ensuring they can pivot and adapt to changing market conditions driven by technological advancements.

– **Invest in AI**: There is a growing need for firms to invest in AI capabilities, whether through acquisition, partnerships, or internal development, to remain competitive in their sectors.

– **Monitor Regulatory Developments**: As AI continues to advance, regulatory scrutiny is likely to increase. Companies should stay informed and prepared for potential regulations that may impact their operations.

– **Focus on Ethical Considerations**: The ethical implications of AI deployment are paramount. Companies must consider the societal impact of automation and strive to create solutions that benefit both their business and the broader community.

## Conclusion: A New Era for Tech Stocks

The recent downturn in tech stocks serves as a stark reminder of the complexities introduced by AI. While the technology holds immense potential to enhance efficiencies and drive innovation, it also poses significant risks to traditional revenue models. As the market recalibrates and companies reassess their strategies, investors must remain vigilant and adaptable.

The evolution of AI is an ongoing narrative, one that will undoubtedly shape the future of the tech industry for years to come. How companies navigate this transformative landscape will determine their success or failure in an increasingly competitive market.

Source: https://fortune.com/2026/02/04/tech-stocks-palantir-anthropic-ai-cut-reduce-revenues/

Leave a Reply