In recent months, the financial world has been closely watching the Federal Reserve, particularly in light of potential leadership changes. The nomination of Kevin Warsh as the new chair of the Federal Reserve has stirred a mixture of hope and skepticism among economists and investors. As discussions around the Fed’s monetary policy evolve, understanding the implications of a dovish approach to interest rates is critical for all stakeholders in the economy.

### The Dovish Stance: What Does It Mean?

A dovish Federal Reserve typically advocates for lower interest rates to stimulate economic growth. This approach can help increase consumer spending and encourage businesses to invest, which is essential in a recovering economy. Conversely, a hawkish stance would prioritize controlling inflation, often leading to higher interest rates that can curb borrowing and spending.

Warsh’s potential leadership has raised questions about how aggressively he would pursue rate cuts. His previous tenure at the Fed and his current views suggest that he may favor a more accommodative monetary policy, which could have far-reaching implications for various sectors of the economy.

### The Changing Landscape of U.S. Monetary Policy

The Federal Reserve’s role has evolved significantly since the 2008 financial crisis. It has become a central player in managing economic stability through unconventional monetary policies, including quantitative easing and maintaining near-zero interest rates. As the U.S. economy faces new challenges, such as rising inflation and global economic uncertainties, the Fed’s decisions are more critical than ever.

Warsh’s appointment comes at a time when the economy is grappling with the aftereffects of the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions. The need for a balanced approach is apparent. However, the effectiveness of a dovish policy in such turbulent times is still debatable.

### The Implications of a Dovish Policy

#### 1. **Interest Rates and Borrowing Costs**

With a dovish Fed led by Warsh, we could see further reductions in short-term interest rates. Lower borrowing costs would likely support consumer spending, as loans for homes, cars, and business investments become more affordable. This could lead to increased demand across various sectors, driving economic growth.

However, it’s essential to remain cautious. A prolonged period of low rates can lead to asset bubbles, particularly in real estate and equities. Investors must weigh the benefits of cheap capital against the potential risks of over-leveraging.

#### 2. **Bond Markets: A Complex Scenario**

Warsh has indicated a desire to shrink the Fed’s bond holdings, which could result in higher long-term yields. This policy could create a steeper yield curve, as the central bank would no longer buy as many longer-dated bonds. Typically, a steeper yield curve suggests that investors expect stronger economic growth and inflation in the future.

However, this situation creates a conundrum. Treasury Secretary Scott Bessent’s preference for capping longer-term yields contradicts Warsh’s apparent inclination to allow market forces to dictate bond prices. This internal discord could lead to market volatility and uncertain investor sentiment.

#### 3. **Inflation Concerns**

While a dovish approach may encourage growth, it also raises concerns about inflation. The U.S. has witnessed an uptick in inflation rates, fueled by supply chain disruptions and increased consumer demand. If the Fed prioritizes stimulating the economy without adequately addressing inflation, it could lead to an overheated economy.

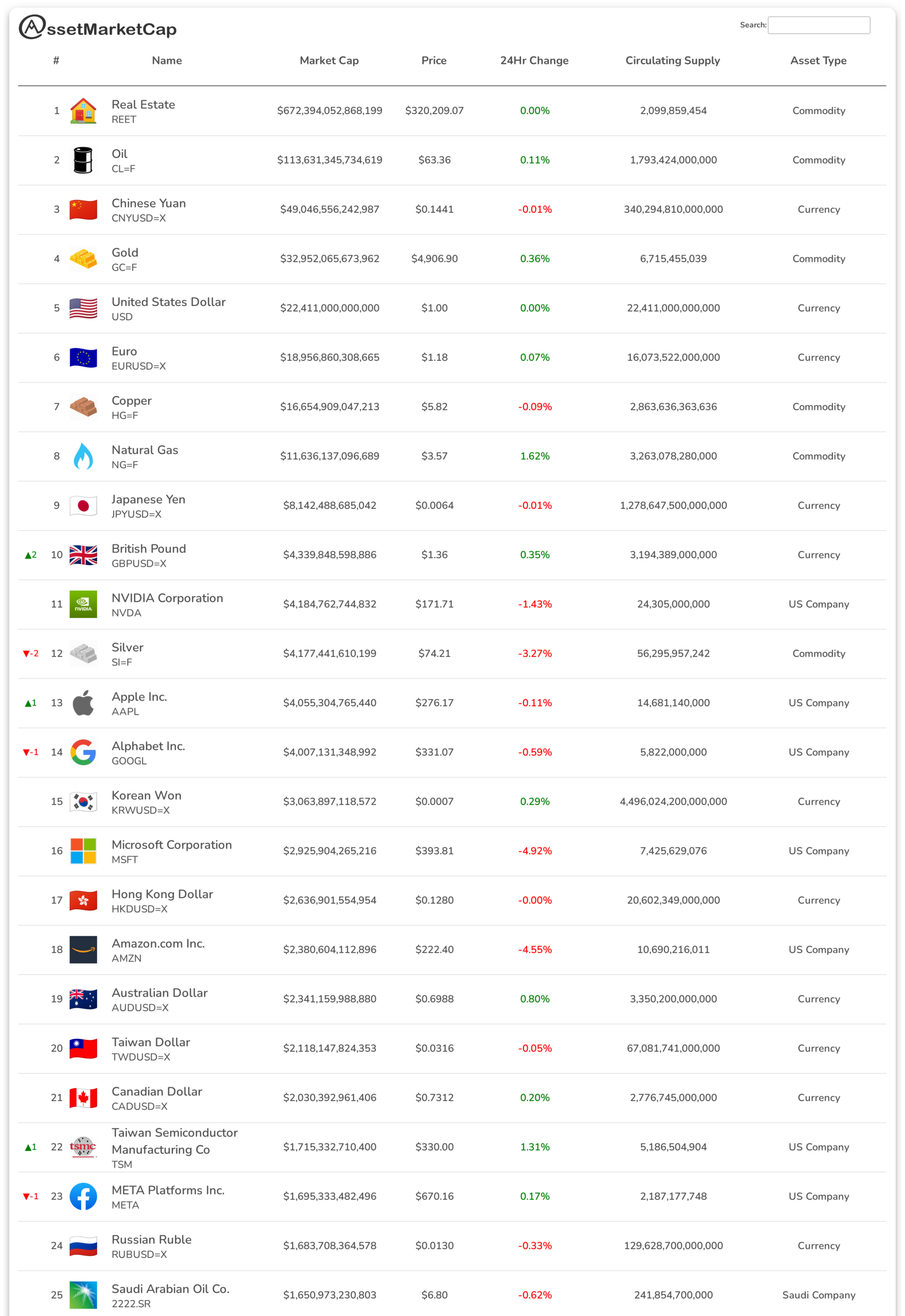

For consumers, this could mean higher prices for everyday goods and services. Investors must stay vigilant and consider strategies to hedge against inflation, such as diversifying portfolios with assets like real estate or commodities.

### Real-World Examples: Lessons from the Past

Historically, the Federal Reserve’s policies have had profound effects on both markets and the broader economy. For instance, during the 2008 financial crisis, the Fed implemented aggressive rate cuts and quantitative easing to stabilize the economy. While these actions helped prevent a deeper recession, they also contributed to rising asset prices and increased wealth inequality over time.

Similarly, in the years leading up to the COVID-19 pandemic, low interest rates encouraged significant borrowing and investment, but they also led to concerns about inflation and asset price bubbles. These past experiences highlight the delicate balance the Fed must strike in its monetary policy approach.

### The Role of Gold and Alternative Investments

In an environment of uncertain monetary policy, many investors are turning to alternative assets like gold. Traditionally viewed as a hedge against inflation and currency devaluation, gold can provide diversification benefits in a portfolio.

Recent fluctuations in gold prices illustrate the market’s reaction to Fed policy expectations. A rapid sell-off in gold at the end of a trading week may not have been solely a response to Warsh’s potential appointment. Instead, broader market trends and speculative behaviors were likely at play. Investors who have seen their gold holdings increase as a share of their portfolios may need to consider rebalancing to maintain their desired asset allocation.

### The Path Forward: A Balanced Perspective

As Warsh prepares to take the reins at the Federal Reserve, it’s crucial for him to establish his authority and clarify his vision for U.S. monetary policy. The financial markets are sensitive to signals from the Fed, and any missteps could trigger adverse reactions in both the stock and bond markets.

For investors, understanding the nuances of Fed policy is essential. Adopting a balanced perspective means recognizing both the opportunities and risks associated with a dovish central bank. As the economic landscape continues to evolve, staying informed and adaptable will be key to navigating the complexities of modern finance.

### Conclusion

The potential impact of a dovish Federal Reserve under Kevin Warsh’s leadership is a multifaceted issue that extends beyond simple interest rate adjustments. As economic conditions fluctuate and the Fed grapples with competing priorities, both consumers and investors must remain vigilant.

In these uncertain times, it’s vital to stay informed, diversify investments, and be prepared to adjust strategies as the economic landscape shifts. With the right approach, stakeholders can navigate the complexities of a changing financial environment and take advantage of the opportunities that arise.

With the Fed at a crossroads, the implications of its decisions will resonate throughout the economy for years to come. Understanding the broader context and potential outcomes will empower individuals and investors alike to make informed financial decisions in the face of uncertainty.

Source: https://moneyweek.com/economy/us-economy/how-a-dovish-federal-reserve-could-affect-you

Leave a Reply