# Trump Media Ventures into Crypto: New ETFs for Bitcoin and Beyond

**SUMMARY:** Trump Media & Technology Group has filed with the SEC for two new crypto ETFs linked to Bitcoin and Ether. Amidst a backdrop of recent outflows from spot Bitcoin ETFs, these new products aim to provide diverse investment opportunities. This move marks a notable step in Trump’s ongoing engagement with the cryptocurrency market.

## Introduction: A New Chapter in Cryptocurrency Investment

The cryptocurrency market has seen its fair share of ups and downs, and now, it’s about to experience a significant new development. Recently, the Trump Media & Technology Group (TMTG), the media company founded by former President Donald Trump, announced its filing for two new exchange-traded funds (ETFs) linked to major cryptocurrencies: Bitcoin (BTC) and Ether (ETH). This announcement comes at a time when traditional cryptocurrency investment vehicles, particularly Bitcoin ETFs, are experiencing significant outflows, raising questions about the future of these financial products.

In this article, we will delve into the implications of TMTG’s move into the crypto ETF space, analyze the current state of Bitcoin ETFs, and examine broader trends in cryptocurrency investments.

## The Launch of Truth Social ETFs

On a Friday earlier this month, TMTG’s Truth Social Funds arm disclosed its intention to launch the Truth Social Bitcoin and Ether ETF, alongside the Truth Social Cronos Yield Maximizer ETF. While the filing is currently under review by the U.S. Securities and Exchange Commission (SEC) and has yet to take effect, the potential for these ETFs to reshape the crypto investment landscape is considerable.

### Background on the ETFs

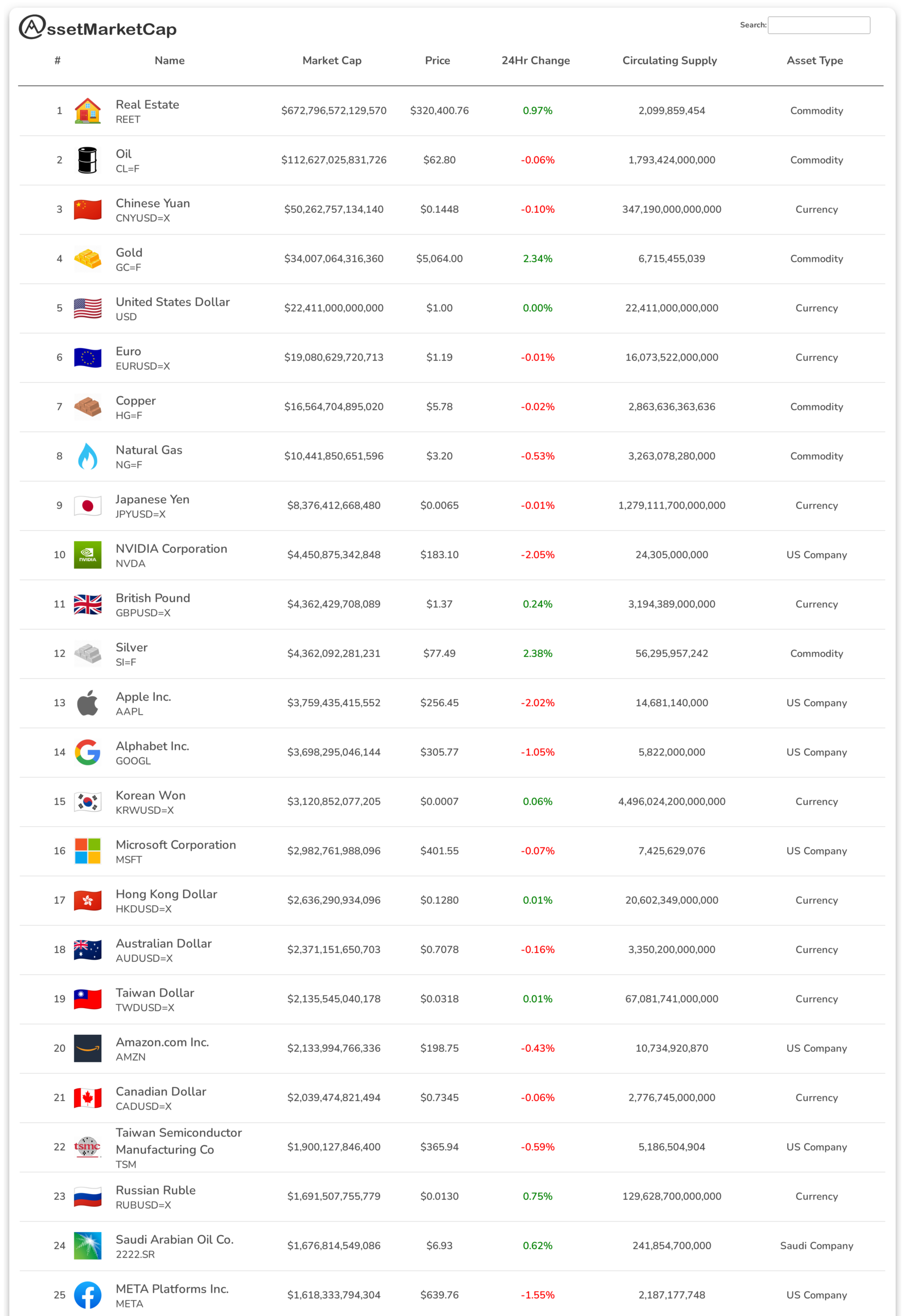

– **Truth Social Bitcoin and Ether ETF:** This fund aims to track the combined performance of Bitcoin and Ether, the two largest cryptocurrencies by market capitalization. In addition to capital appreciation, the ETF will also capture staking rewards generated from Ether, which offers additional income opportunities for investors.

– **Truth Social Cronos Yield Maximizer ETF:** This fund is designed to follow the performance of Cronos (CRO), the native token of Crypto.com’s blockchain. Similar to the Bitcoin and Ether fund, this ETF will also incorporate staking income, thus enhancing its appeal to yield-seeking investors.

### The Role of Crypto.com

A crucial partner in this venture is Crypto.com, a prominent cryptocurrency exchange. Crypto.com is expected to provide essential services such as custody, liquidity, and staking for the new ETFs, provided that regulators grant approval for these products. Investors will have access to these ETFs through Crypto.com’s broker-dealer, Foris Capital US LLC. The anticipated management fee for each product is set at 0.95%.

## Market Context: The Current State of Bitcoin ETFs

While TMTG’s entry into the crypto ETF market could be seen as a positive development, it arrives at a challenging time for existing Bitcoin ETFs. Recent data highlights a concerning trend: U.S. spot Bitcoin ETFs have recorded four consecutive weeks of net outflows, with approximately $360 million withdrawn in the latest week alone.

### Understanding the Outflows

The recent outflows from Bitcoin ETFs can be attributed to several factors:

– **Market Volatility:** The cryptocurrency market is notoriously volatile, which can deter investors seeking stable returns. In late January and early February, the market experienced significant fluctuations, leading to heightened caution among investors.

– **Investor Sentiment:** A declining investor sentiment towards cryptocurrencies, particularly Bitcoin, has influenced withdrawal patterns. Reports indicate that the largest recent withdrawals occurred on January 29, January 30, and February 4, totaling over $2 billion in outflows.

– **Alternative Investment Opportunities:** As traditional markets recover, some investors may be reallocating their capital into equities or bonds, which they perceive as safer investments during uncertain times.

### Comparison with Inflows

Despite the negative sentiment reflected in the outflows, there have been sporadic inflows into Bitcoin ETFs. For instance, on February 2 and February 6, the ETFs saw inflows of $561.89 million and $371.15 million, respectively. However, these inflows were not sufficient to counterbalance the larger outflow trend.

## Analyzing TMTG’s Strategy

TMTG is not new to the crypto space; the company has been exploring various cryptocurrency initiatives in recent years. In April 2022, TMTG announced a partnership with Crypto.com and Yorkville America Digital to launch a series of “Made in America” ETFs that combine digital assets with traditional securities. This included sectors such as energy, which could be attractive to environmentally conscious investors looking for sustainable investment opportunities.

### Investment Advisor Yorkville America Equities

Steve Neamtz, president of Yorkville America Equities, which is set to serve as the investment adviser for the new ETFs, stated, “We plan to provide an investment platform for investors covering multiple aspects of digital and crypto investing with both capital appreciation and income opportunities.” This statement underscores TMTG’s strategy to cater to a diverse investor base, from conservative income-seeking investors to more aggressive capital growth investors.

## Broader Implications for the Cryptocurrency Market

The introduction of new cryptocurrency ETFs by TMTG could have several implications for the broader market:

### Increased Legitimacy for Crypto

TMTG’s foray into crypto ETFs could further legitimize the cryptocurrency market in the eyes of traditional investors. The association with a high-profile entity like TMTG may attract a more mainstream audience to the crypto investment space.

### Staking as a Core Investment Strategy

The focus on staking rewards in both the Bitcoin and Ether ETF, as well as in the Cronos Yield Maximizer ETF, suggests a growing acceptance of staking as a viable investment strategy. This could pave the way for more funds and investment products that incorporate staking, making it a cornerstone of crypto investment strategies.

### Regulatory Scrutiny

As TMTG’s ETFs await SEC review, the outcome of this process will be closely watched. Approval could set a precedent for future cryptocurrency ETFs and influence how regulators approach the burgeoning crypto market. Conversely, if denied, it may dampen enthusiasm for crypto investment products.

### Market Adaptation

The introduction of new ETFs will likely encourage existing investment vehicles to adapt and innovate in order to remain competitive. This could lead to the emergence of more diversified products that cater to specific investor preferences and risk appetites.

## Conclusion: The Road Ahead for Trump Media and Cryptocurrency ETFs

Trump Media’s filing for two new cryptocurrency ETFs marks an intriguing chapter in the ongoing evolution of crypto investment products. As the market grapples with significant challenges, including outflows from existing Bitcoin ETFs, TMTG’s initiatives could offer a fresh perspective and new opportunities for investors.

However, the success of these ETFs will depend significantly on the regulatory landscape, investor sentiment, and the overall health of the cryptocurrency market. As we move forward, the intersection of traditional finance and cryptocurrencies will continue to evolve, promising both risks and opportunities for investors.

In the ever-changing world of finance, one thing remains clear: the relationship between cryptocurrencies and traditional investment vehicles is becoming increasingly intertwined, and market participants will need to stay informed to navigate this complex landscape effectively.

Leave a Reply