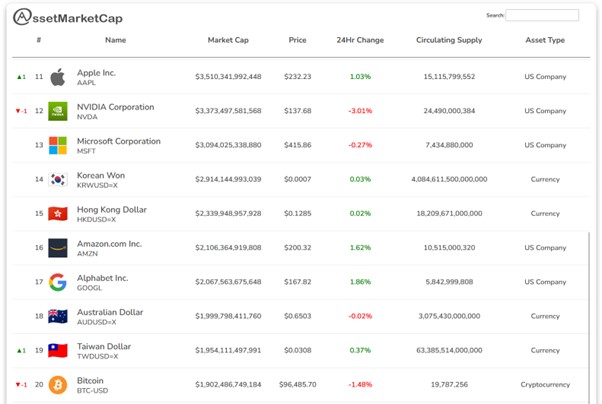

November 25, 2024 — In a dramatic turn of events, Apple (AAPL) has surpassed Nvidia (NVDA) in market capitalization today, reclaiming the crown as the world’s most valuable company. Apple’s market cap has risen to $3.51 trillion, overtaking Nvidia, which now stands at $3.47 trillion, as the tech giant continues to capitalize on its diverse portfolio and innovative growth.

This marks the latest chapter in the fierce battle between the two Silicon Valley titans for supremacy in the global stock market. With Apple’s resurgence, it not only underscores the enduring strength of its business model but also reflects broader trends within the tech industry, where the intersection of hardware, software, and services continues to shape the future of global markets.

Apple’s Resurgence and Reclaiming the Throne

Apple’s market cap of $3.51 trillion puts it back on top, ending Nvidia’s brief reign as the world’s most valuable company. Nvidia, once again, has proven its formidable presence as a leader in the semiconductor space — particularly in AI and graphics processing units (GPUs) — but today’s flip signals that Apple’s vast ecosystem of products and services remains an unbeatable force.

The shift comes at a time when both companies are riding high on significant product and technological advancements. For Apple, the surge in its stock price is largely attributed to strong quarterly earnings, sustained demand for its flagship iPhone 15 series, and its growing ecosystem of hardware and services. Additionally, Apple’s foray into augmented reality (AR), its continuous push in wearables, and the strategic expansion of its services division (including Apple TV+, iCloud, and the App Store) have helped fuel its growth.

Despite Nvidia’s exceptional growth, particularly driven by the AI boom and demand for GPUs, Apple’s ability to generate enormous revenue across multiple sectors has allowed it to once again surpass Nvidia in terms of market value. Apple’s diversified business model, which spans consumer electronics, software, digital services, and even original content production, has given it a unique advantage in an increasingly complex tech landscape.

Nvidia’s Dominance in AI and GPUs

While Apple may have overtaken Nvidia today, the latter’s remarkable growth story remains at the forefront of the tech world. Nvidia has capitalized on the explosive demand for artificial intelligence (AI) hardware, driven by the global surge in AI applications, machine learning, and generative technologies.

Nvidia’s GPUs — particularly its A100 and H100 models — have become critical components for data centers, cloud computing, and AI research. The company’s role in powering cutting-edge AI models like OpenAI’s GPT and Google’s DeepMind has positioned Nvidia as an essential player in the ongoing AI revolution. Nvidia’s recent quarterly earnings report reflected record sales, primarily driven by its Data Center and Gaming segments, further cementing its role as the leader in next-generation semiconductor technologies.

Despite Apple’s market cap flip today, Nvidia remains a leader in AI and graphics innovation, with analysts predicting that the company will continue to benefit from the growing adoption of AI across industries. However, Apple’s ability to leverage its dominance in hardware, software, and services gives it the edge when it comes to long-term market sustainability and scalability.

The Tech Rivalry: A Battle of Business Models

The competition between Apple and Nvidia offers a fascinating insight into the different paths tech companies can take to success in the 21st century.

- Apple’s Ecosystem: Apple’s business model is centered around creating a seamless ecosystem of interconnected products and services. From the iPhone to the iPad, MacBook, and the Apple Watch, each of Apple’s devices is designed to work together, creating a loyal customer base and a steady stream of recurring revenue. The company has also emerged as a leader in wearables (such as the Apple Watch) and services, with a rapidly growing digital media division that includes subscriptions to Apple Music, Apple TV+, and iCloud.

- Nvidia’s Innovation in AI: Nvidia, on the other hand, is betting big on AI and high-performance computing. The company has cornered the market on GPUs, which are used for AI training, gaming, and creative work. Nvidia’s technologies have become foundational for companies building large AI models, and its hardware is widely used in research institutions, data centers, and by enterprises seeking to leverage the power of machine learning.

While Nvidia is driving the AI revolution with its specialized hardware, Apple is creating a comprehensive digital lifestyle for consumers that blends hardware, software, and services. Each company’s strategy has its strengths and challenges, but Apple’s diversified approach appears to offer more resilience in the face of market volatility.

Why Apple’s Flip Matters

Apple’s reclaiming the title of the world’s most valuable company has several important implications for the tech industry and the broader market:

- Strength of Ecosystem: Apple’s success underscores the strength of its vertically integrated business model, where it controls both the hardware and software of its products, creating a seamless user experience that keeps customers coming back. This level of integration allows Apple to not only generate significant revenue from device sales but also monetize through services like iCloud, Apple TV+, and its App Store.

- Sustained Innovation: Apple’s continued focus on innovation — especially in AR, wearables, and AI — positions it to remain competitive in a rapidly evolving technological landscape. Its ability to tap into new markets, while retaining a massive user base, gives it an edge in adapting to future trends.

- The Resilience of Consumer Technology: Apple’s position highlights the resilience of consumer technology companies, even in the face of economic uncertainty and supply chain challenges. The company’s brand loyalty, vast product ecosystem, and consistent innovation allow it to weather market downturns better than many other tech companies.

- Investor Sentiment: For investors, today’s flip is a reminder of the unpredictability of stock market valuations. While Nvidia remains a powerhouse in AI, today’s market cap shift reflects the broader investor sentiment that Apple’s diversified strategy has better prospects for long-term growth and sustainability.

Looking Ahead: A Continued Rivalry

As of today, Apple has reclaimed the top spot, but the rivalry between the two companies is far from over. Both Apple and Nvidia are likely to continue to grow in their respective areas of strength. The rise of artificial intelligence and machine learning presents continued opportunities for Nvidia to expand its footprint, while Apple’s continued push into AR, services, and wearables suggests that it remains a dominant force in the consumer technology sector.

It’s clear that both companies are well-positioned for the future, but for now, Apple’s return to the top demonstrates the enduring power of its brand, ecosystem, and business model. For tech enthusiasts and investors alike, the rivalry between Apple and Nvidia will remain a fascinating battle to watch as the tech landscape continues to evolve.

Conclusion

Apple’s flip of Nvidia today to reclaim the title of the world’s most valuable company underscores the fierce competition between two of the most influential players in the tech sector. Apple’s diversified ecosystem and continued innovation in hardware, software, and services have enabled it to regain the crown, while Nvidia’s dominance in AI and GPU technology solidifies its place as a critical player in the future of computing. The battle between these two giants will likely continue to shape the landscape of technology for years to come.

Leave a Reply