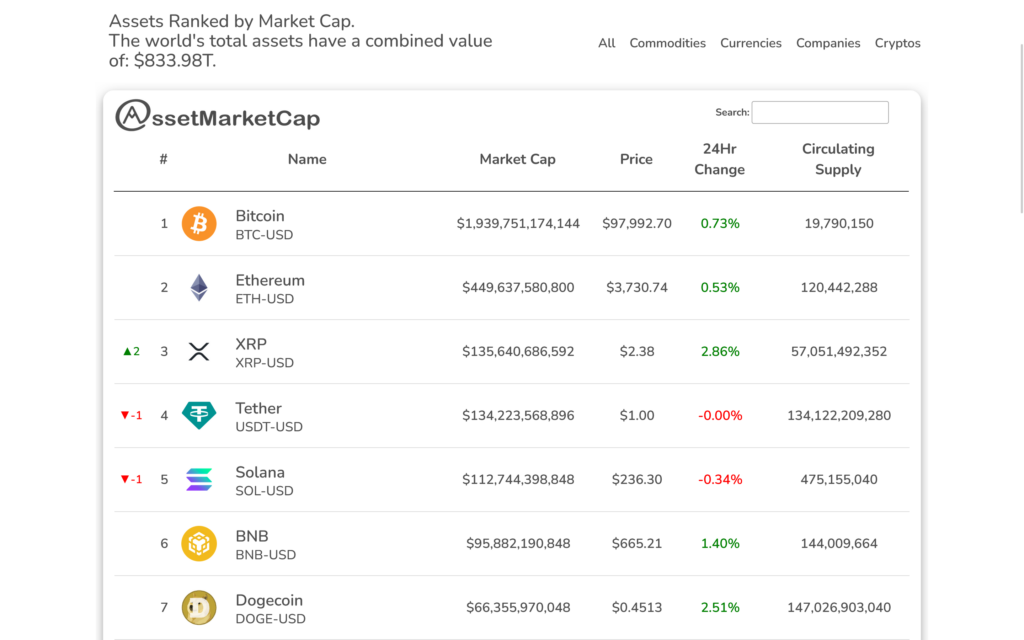

The cryptocurrency market is abuzz with excitement as Ripple (XRP) rockets to the third spot in global rankings, surpassing Tether (USDT) and Solana (SOL). Ripple’s price surged by as much as 20% on Sunday, reaching $2.40, and is now up over 100% for the week. This rally has pushed Ripple’s market capitalization to $135 billion, securing its position as a top-three cryptocurrency.

The surge in XRP’s price is attributed to a groundbreaking leak: Ripple is reportedly preparing to launch RLUSD (Ripple Labs United States Dollar), a regulatory-approved stablecoin designed to revolutionize global finance.

Ripple’s Surge: The RLUSD Leak

The leaked news of RLUSD has sent shockwaves through the crypto world. Unlike many stablecoins currently on the market, RLUSD is expected to be fully compliant with U.S. and international regulations, positioning Ripple at the forefront of the stablecoin revolution.

The introduction of RLUSD signifies Ripple’s ambition to expand its role beyond cross-border payments into broader financial services, offering a fully regulated stablecoin that bridges traditional finance and blockchain technology.

Here’s why RLUSD is a game-changer:

- Regulatory Approval: The leak suggests that RLUSD has already gained approval from key financial regulators, including those in the United States. This is a major step forward for Ripple, especially in light of its recent partial victory in its legal battle with the SEC, which helped clarify XRP’s regulatory status.

- Strengthening RippleNet: RLUSD is expected to integrate seamlessly into Ripple’s global payment network, RippleNet. This will provide financial institutions and corporations with a stable, blockchain-based alternative for settling transactions, enhancing the ecosystem’s utility.

- Competing with Tether: Tether (USDT) has long dominated the stablecoin market, but RLUSD’s regulatory compliance and integration with Ripple’s established infrastructure could pose a serious challenge to USDT’s market share.

The Ripple Effect on XRP

The news of RLUSD has sparked a surge of investor interest in XRP, as market participants anticipate a significant increase in Ripple’s utility and adoption. XRP, which serves as the bridge asset in Ripple’s payment ecosystem, is expected to benefit from the new stablecoin’s launch, driving demand and price appreciation.

This excitement has translated into a 20% price increase on Sunday alone, with XRP now trading at $2.40—more than double its price from a week ago. The rally has catapulted Ripple’s market cap to $135 billion, making it the third-largest cryptocurrency.

Tether and Solana: Ripple’s New Peers

While Ripple enjoys its moment in the spotlight, Tether and Solana remain key players in the market:

- Tether (USDT): The largest stablecoin by market cap continues to fulfill its role as a critical source of liquidity. While Tether remains pegged to $1 and unaffected by price fluctuations, the introduction of RLUSD could present competition by offering a fully compliant, institution-friendly alternative.

- Solana (SOL): Solana, previously ranked third, has seen its market cap drop as Ripple’s surged. Despite its high-speed blockchain and growing ecosystem, Solana faces challenges from network reliability concerns and increasing competition in the layer-1 space.

Broader Market Implications

Ripple’s ascent to the third spot signals a turning point for the crypto market. The leak of RLUSD not only underscores the importance of regulatory compliance in driving adoption but also highlights the market’s growing preference for projects with real-world applications.

This development also comes amid other favorable tailwinds for Ripple and the broader crypto market:

- Re-election of Pro-Crypto Donald Trump: Trump’s victory has reinvigorated optimism about a supportive regulatory environment for blockchain innovation. His administration has pledged to reduce barriers for crypto businesses, creating fertile ground for projects like Ripple.

- Resignation of SEC Chair Gary Gensler: Gensler’s departure has fueled speculation that the SEC may adopt a more balanced approach to crypto regulation. Ripple, which has been a focal point of the SEC’s scrutiny, is poised to benefit from this shift.

What’s Next for Ripple?

Ripple’s leak of RLUSD is a bold step that could redefine the stablecoin market and cement its dominance in blockchain-based financial services. With a compliant stablecoin, Ripple is poised to attract institutional clients seeking a secure and regulated alternative for transactions and settlements.

As Ripple continues to innovate, its next challenge could be Ethereum (ETH) as it edges closer to competing for the number-two spot in the cryptocurrency rankings. However, success will depend on the official launch of RLUSD, further regulatory clarity, and the company’s ability to sustain its growing adoption.

For now, Ripple’s rise to $2.40 and a market cap of $135 billion has marked a new chapter in its journey, solidifying its position as one of the most influential projects in the cryptocurrency space.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risks, and readers are encouraged to conduct thorough research before investing.

Leave a Reply